In Part 2 of this series, we look at other dynamics to consider when constructing a balanced bond portfolio. This week Joseph Kingsley looks at an issuer’s capital structure and debt stack that bondholders lend to, and secondly the rating agencies

and how bonds are rated.

Background

Last week we discussed the basics of a diversified portfolio and how to use the three types of bonds (fixed rate, floating rate and inflation linked) to benefit an investor at different times in the interest rate cycle.

But many forget there are several ways we can diversify a bond portfolio to make it either more or less secure in the search for yield or seeking further safety and security. The two methods portfolio managers will look to employ are by positioning higher

or lower on an issuer’s capital structure or by using the rating agencies credit ratings. These two measures combine to allow bondholders to make an informed investment decision.

Capital Structure

Corporate bonds have different levels of risk and are classified as senior secured debt, senior unsecured debt or subordinated debt. The banking system has separate regulations and has a few other classifications contained within their capital structure.

These include Senior Non-Preferred, Tier 2 Subordinated debt, AT1 or Additional Tier 1 securities and hybrids. The chart below in Figure 1 shows the capital structure for a major bank, with equities or shares sitting below the debt.

Figure 1: Capital structure

Bank hybrids that meet the Australian Prudential Regulation Authority’s (APRA) prudential standards to be treated as regulatory capital are classified as either Additional Tier 1 or Tier 2.

The capital structure is important to know because should a corporate or bank default or proceed into administration, receivership, or liquidation then it’s this structure that will determine the priority of which investors receive their funds back

first and who will have losses applied first.

The higher up the capital structure your debt sits, the more secure your investment; however, even senior secured bondholders can receive less than their original principal back in an extreme default scenario or where the businesses have been poorly managed.

The position in the capital structure will also determine the rate of return you can potentially receive from the issuer with the higher up the structure the lower the applicable interest rate. This is due to the lower perceived risk of your principal

suffering loss. The reverse is also true where an investor who is comfortable with the overall or underlying risk of the issuer is happy to sit lower on the capital structure in order to receive an enhanced return on their investment.

It is also worth looking at the overall debt stack or pending maturities to see where your bonds sit in order of existing issuance. This becomes important if credit markets become strained, as the risk of your debt being refinanced and returned can deteriorate

should there be aggressive levels of debt refinance required before yours.

All of these factors and scenarios are taken into account by the major rating agencies when looking to apply a credit rating to an issue and also any new bond issue a business may wish to offer.

Credit Ratings

The three major global credit rating agencies that are often quoted when reviewing securities are S&P Global (S&P), Moody’s, and Fitch.

Many of the corporate securities FIIG looks to trade in will be rated by either S&P or Moody’s, or both. However, for many companies it is not mandatory to have a credit rating, only where an issuer wishes to have tradeable securities and access

institutional markets. Most of the debt issuance that FIIG has arranged on behalf of many of our Capital Markets clients does not require a credit rating.

Rating agencies will assign ratings to both the issuer itself as well as an individual bond issue and will consider a variety of financial and non-financial information in assigning a credit rating, including:

- Key performance indicators

- Economic, regulatory, and geo-political influences

- Management and corporate governance attributes

- The terms and conditions of the debt security and, if relevant, its legal structure

- The relative seniority of the issue with regard to the issuer’s other debt issues and priority of repayment in the event of default

- The existence of external support or credit enhancements, such as letters of credit, guarantees, insurance, and collateral. These protections can provide a cushion that limits the potential credit risks associated with a particular issue.

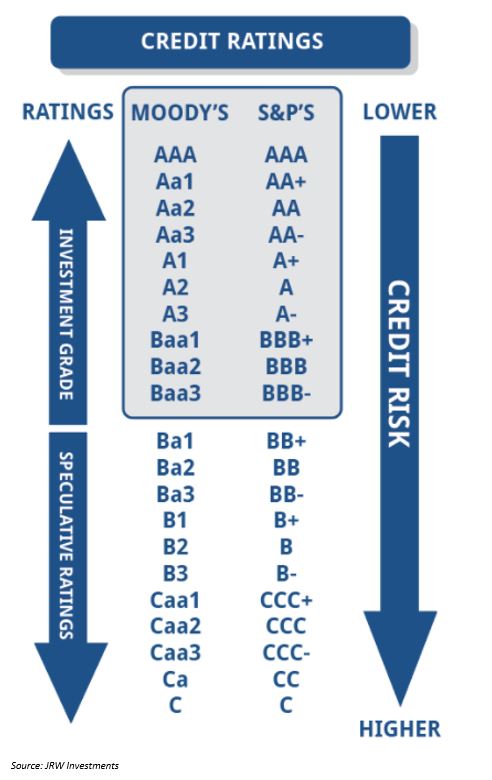

Once all of this is considered, then a rating is assigned. If using S&P’s rating scale this could be from AAA to C- or D in event of default, as Figure 2 below illustrates.

Figure 2: Credit ratings

Again, using S&P’s rating scale, any rating of BBB- and above is considered investment grade, whilst BB+ and below is termed speculative grade, or less formally as junk bond status. Using S&P’s own guidance for this:

“The term “investment-grade” historically referred to bonds and other debt securities that bank regulators and market participants viewed as suitable investments for financial institutions. Now the term is broadly used to describe issuers and issues with relatively high levels of creditworthiness and credit quality. In contrast, the term “non-investment-grade,” or “speculative-grade,” generally refers to debt securities where the issuer currently has the ability to repay but faces significant uncertainties, such as adverse business or financial circumstances that could affect credit risk.”

Source: S&P Guide to Credit Rating Essentials

When assigned an investment grade credit rating, bonds will generally trade on comparative yields with other similar securities and maturities. Generally, the higher the rating, the lower the yield, all else remaining equal to reflect the lower risk of

the security.

Depending on an investors yield return requirements they can then look to move up and down the ratings scale in a search for more yield or more security and defensiveness in their portfolio.

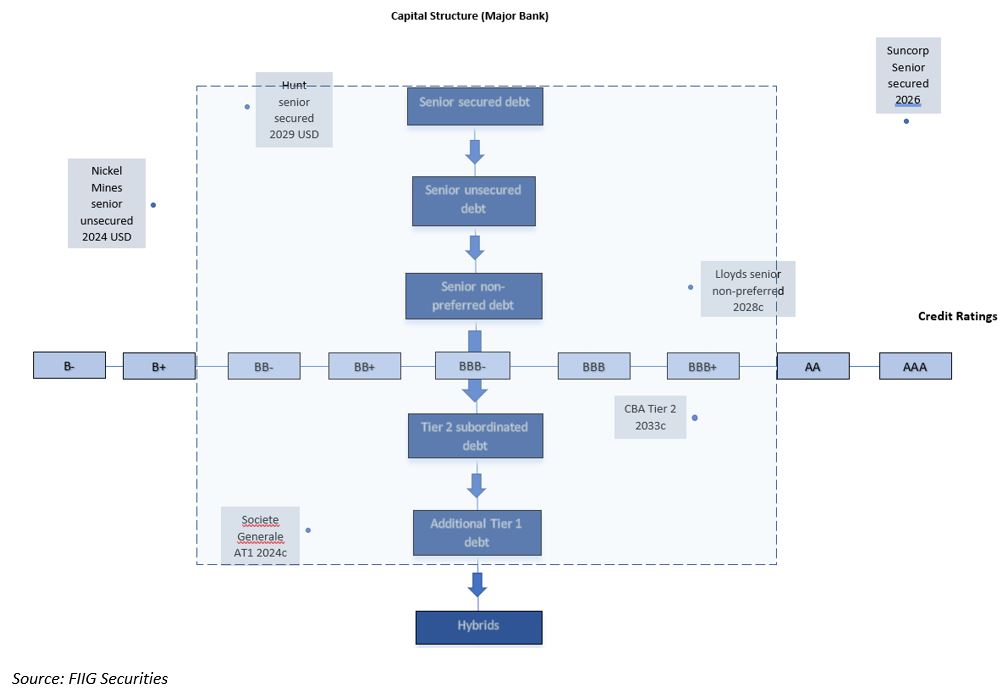

By plotting some recent issuance along with existing issues on a chart, we can see where each of these securities lie in the investment universe, as per Figure 3 below.

Figure 3: Capital structure and credit ratings in practice

Most bonds that we trade at FIIG will sit within the shaded area of the chart below, showing that by going down the capital structure slightly and lower in credit rating, investors are able to achieve a higher return by taking on incremental risk.

By combining the information from the past two series, investors can now start to construct a portfolio that suits their needs and, more importantly, their macro view of the interest rate landscape.

We note that, under existing Australian regulations, credit ratings cannot be disclosed to retail investors.

If you would like to register for one of our upcoming Portfolio Construction seminars, please follow the below links for the one in your state.